9 Simple Techniques For Medicare Advantage Agent

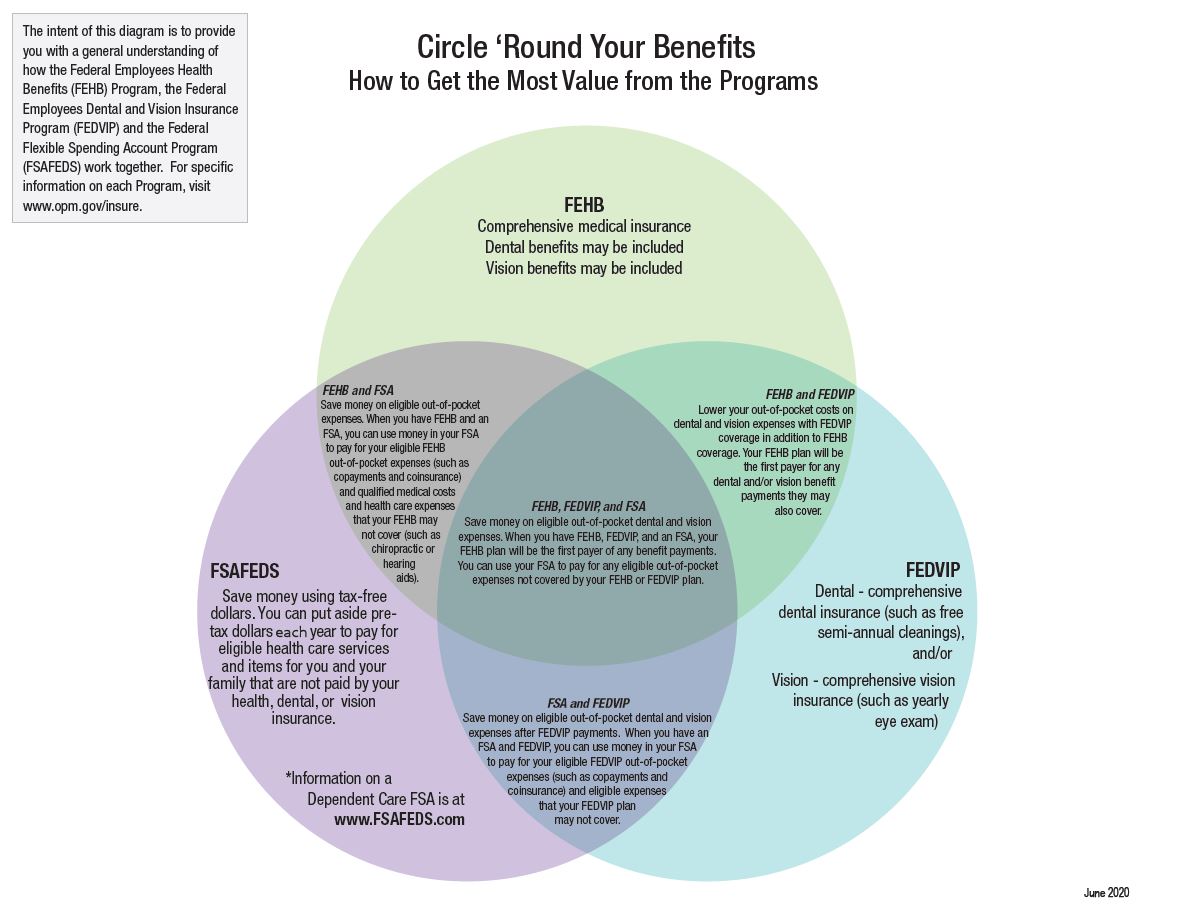

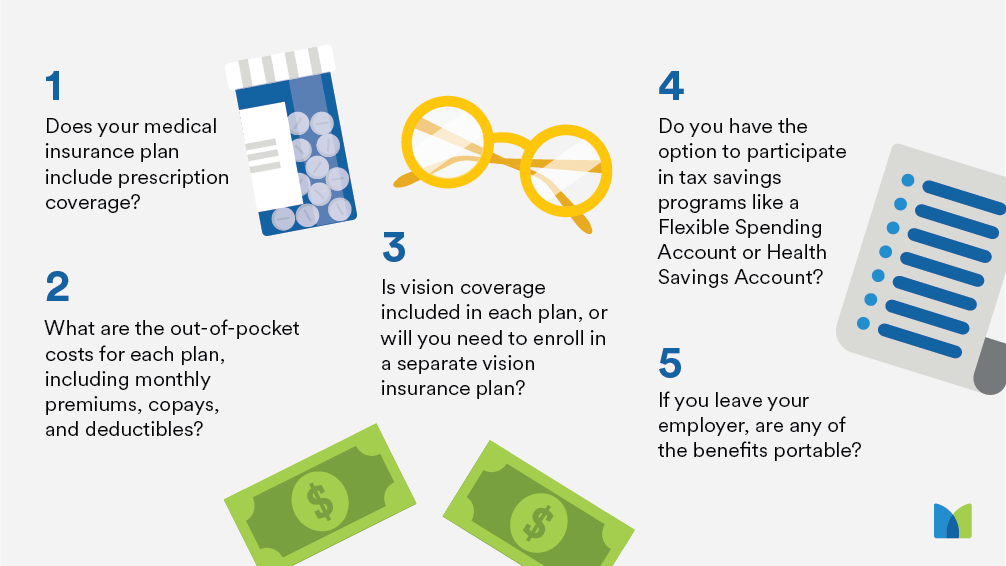

You can use this duration to join the plan if you really did not earlier. Strategies with higher deductibles, copayments, and coinsurance have reduced premiums.

Know what each strategy covers. If you have medical professionals you desire to maintain, make certain they're in the strategy's network. Medicare Advantage Agent.

Some Ideas on Medicare Advantage Agent You Should Know

Make sure your drugs are on the strategy's listing of approved medicines. A strategy won't pay for medicines that aren't on its listing. If you lie or leave something out intentionally, an insurer may cancel your insurance coverage or refuse to pay your insurance claims. Use our Wellness plan shopping overview to shop clever for health and wellness coverage.

The Texas Life and Health And Wellness Insurance Guaranty Organization pays claims for health and wellness insurance policy. It doesn't pay insurance claims for HMOs and some various other types of plans.

Your partner and children likewise can proceed their coverage if you go on Medicare, you and your spouse separation, or you pass away. They should have gotten on your strategy for one year or be younger than 1 year old. Their protection will certainly finish if they get other coverage, do not pay the premiums, or your company quits providing medical insurance.

Some Of Medicare Advantage Agent

You have to inform your company in composing that you desire it. If you proceed your coverage under COBRA, you must pay the premiums on your own. Your company does not need to pay any one of your premiums. Your COBRA protection will certainly be the same as the coverage you had with your employer's strategy.

As soon as you have actually enrolled in a health strategy, make certain you understand your strategy and the price effects of numerous treatments and solutions. Going to an out-of-network doctor versus in-network commonly sets you back a consumer much more for the very same kind of service (Medicare Advantage Agent). When you enroll you will certainly be provided a certificate or evidence of insurance coverage

Medicare Advantage Agent - An Overview

It will certainly likewise tell you if any kind of services have limitations (such as optimum amount that the health insurance plan will spend for durable clinical equipment or physical treatment). And it ought to inform what services are not covered at all (such as acupuncture). Do your research, research all the choices site link available, and assess your insurance plan before making any type of decisions.

Medicare Advantage Agent for Dummies

When you have a medical procedure or go to, you generally pay your health treatment service provider (medical professional, healthcare facility, specialist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your section of the service provider's costs. You anticipate your health insurance plan to pay the remainder of the bill if you are seeing an in-network company.

There are some situations when you might have to file an insurance claim on your own. This could happen when you go to an out-of-network supplier, when the provider does decline your insurance coverage, or when you are taking a trip. If you require to submit your own medical insurance claim, call the number on your insurance coverage card, and the consumer assistance rep can educate you how to file a claim.

Numerous health insurance plan have a time restriction for just how lengthy you need to sue, commonly within 90 days of the service. After you submit the claim, the health and wellness plan has a restricted time (it varies per state) to notify you or your supplier if website here the health insurance plan has actually accepted or rejected the claim.

The Ultimate Guide To Medicare Advantage Agent

If it makes a decision that a service is not clinically needed, the plan might reject or reduce settlements. For some health and wellness plans, this clinical requirement choice is made before therapy. For other health insurance plan, the decision is made when the firm gets a costs from the company. The company will certainly send you an explanation of advantages that describes the solution, the amount paid, helpful resources and any kind of additional quantity for which you may still be liable.

:max_bytes(150000):strip_icc()/GettyImages-1144854947-c7f45fd8855944578e503d57c36e4a0e.jpg)